How much can you put in your Medisave Account?

It has been ages since i’ve written anything. Ever since we came out of lock down the option to work from home no longer existed for Mr Kua Simi. It didn’t help that the nature of my work does not really promote the option to work from home. In addition i’ve taken on more responsibility…

Do you know how to decouple your property?

Why do people want to decouple their properties? Take for example, Ah Beng and Ah Lian who has been happily married for 5 years. They own a 3bd rm Condo in bedok for the last 3 years and are looking to decouple their property. Ah Beng: “Eh, want to buy investment property anot? I heard…

Update to Mapletree NAC Annual statement

About a week ago, I wrote about Mapletree NAC. Click here if you have not read “Let’s breakdown Mapletree’s Annual Report” On the 29th Apr, Mapletree NAC released their Financial results for FY19/20. This report gives us great insights on the impact of COVID-19 and what we can expect for next few quarters. Let’s break…

Have you made your CPF Nomination?

Recently I was exploring the CPF website. Yes Mr Kua Simi is a weird man. Instead of watching Netflix, I spend time reading the CPF website. During this recent exploration, I stumble upon an interesting fact about CPF. Do you know what happens to your CPF when you pass on? Myth: “The gahment will take…

Let’s breakdown AIMS APAC Reit

If you haven’t already notice, Mr Kua Simi likes to look at property related stocks. So here is another one for you. These few days I have been spending time reading up on different companies and breaking down their annual reports. Since now that we are stuck at home nothing to do right? So might…

Let’s breakdown Mapletree’s Annual Report

So you want to get some REITs in Singapore. Someone told you that you should go invest in Mapletree. You go to your trading account and search for Mapletree, and you realise there is more than one counter with the name Mapletree on it. What do you do? What is the difference between all these…

Let’s breakdown Singtel’s Annual report

After studying the 10-K for a while now, I’ve decided to try and put some of that new found knowledge to analysing Singapore companies. So it’s time to attempt to break down one of Singapore’s famous companies… SingTel. Do note, it’s Mr Kua Simi’s first time trying to break down an annual report. So pang…

5 key indicators you should look for in a company

Before investing in any company you will want to understand the company’s products and services. One place you can go to learn more about a business is by reading it’s 10-K. Click here if you have not read “How to read a company’s 10-K” In my research online I’ve gather 5 key indicators you can…

Why is Oil at WAR?

So you go to the gas station to get some gas…. “Wah shoik sial, how come now gas prices now so cheap???” If you are asking this question read on to find out more. Supply and Demand Concept First let’s make sure you understand the concept of supply and demand. If Supply increases or Demand…

How do I determine the value of a stock?

So you are interested in purchasing a stock, you go to google and they tell you that the company is currently trading at $154 dollars per share. How do you know if you are getting a good deal? Is this stock under valued or over valued? Today we are going to look at a giant…

How do you analyse a REIT’s income statement?

So you have read through the last two articles on How to analyse a REIT’s 10-K which primarily talked about the balance sheet. Let’s now take a look a the income statement of REALTY INCOME and see what those numbers say. The total revenue for 2019 is at approximate $1.5billion and the total expense is…

How to analyse a REIT’s 10-K Part 2

Ok guys, welcome back to part 2 to How to analyse a REIT’s 10-K. If you have not read part 1, you might want to go back to the previous article and read that first. Now that we have got that out of the way, lets go into those numbers. What does the numbers say?…

How to analyse a REIT’s 10-K?

So today we are going deep into the 10-K of a REIT. If you have not read my previous article on How to read a company’s financial report, you might want to read that first. Firstly, let’s just say that the concept of understanding any company’s 10-K is largely the same. But when it comes…

Selling your house is like going on a first date!

Mr Kua Simi thinks that selling a house is like going for a first date. The first thing you have to do is get yourself a date! That’s like saying, before you even get to sell your house, you need an interested buyer to set up a viewing right? Let’s get you that first date!…

How to use those numbers on a Balance Sheet?

So if you have read my previous article, you should have familirised yourself with a 10-K. Let’s now look at what these numbers mean to a company. There are many ways to look at these numbers. Here is a few way I have researched online, on how you can use those confusing numbers to get…

How to read a Company Annual financial report?

Mr Kua Simi always wanted to understand a company’s Financial Report. But then never ever had the time to properly learn how to dissect one of those mambo jumbo reports. With the recent outbreak of COVID-19, I have little more time on my hands. As such, i’ll be spending some time learning and sharing with…

What happened in 2008 during the property bubble burst?

If you have been walking this earth for a considerable amount of time, you’ve probably heard of the 2008 property market crash in the United States. You might have also heard of terms such as Sub Prime Mortgages or Mortgage Backed Securities. Any idea what they mean? Do you actually know what happen back then?…

What is A REITS and should you be buying REITS?

What Is a Real Estate Investment Trust (REIT)? Never heard of a REIT? Here’s an extract of investopedia on what is a REIT. “A real estate investment trust (REIT) is a company owning and typically operating real estate which generates income. Most REITs specialize in a specific real estate sector, focusing their time, energy, and funding…

IS Your HDB Grant Really “FREE” money?

During your process of planning the purchase of your first HDB you’ve probably heard from friend’s, family or colleagues that HDB is giving out “FREE” money also known as grants. You wonder to yourself “How do get some of that “FREE” money for myself?” Let’s look at what are the different kinds of HDB grants…

What can I use my CPF for?

Before we go into what can I use my CPF for, let’s ask ourselves “What is CPF designed for?” Extracted from CPF Website this is the definition/reason of having CPF. “The Central Provident Fund (CPF) is a comprehensive social security system that enables working Singapore Citizens and Permanent Residents to set aside funds for retirement.…

Just started working? what you should do with all that money?

So you just graduated from university and you found yourself your “Dream Job”. Money starts “pouring” into your bank account like you’ve never seen. You ask yourself “What should I do with this money?” Go on holiday? Buy a Car? Buy new watch? Invest my money? Buy more clothes? Give my parents some money? Here…

Is your CPF the Devil or an Angel?

The Singapore CPF is a very powerful tool. However, depending on how you intend to use your CPF, it can work for you or against you. There are many things you can do with your CPF. Click here if you would like to know more about “What can I use my CPF for?” However, it…

What can I do to minimise the impact of accrued interest if I need to take a HDB loan?

In a previous article “Do I need to wipe out my CPF OA account when buying my HDB?” we have established that you will need to WIPE OUT your CPF OA account if you were planning to take a HDB loan (with the exception of the option to leave $20,000 in your OA). In that…

Do I need to wipe out my CPF OA account when buying my HDB?

Do I need to wipe out my CPF OA account when buying my HDB? In one of my previous post I compared the pro and cons of using your CPF to make your mortgage payments. We established the fact that the more CPF you use for the payment of your house the more accrued interest…

How can I put my CPF on steroids?

In one of my previous articles I talked about trying not use our CPF and use as much cash as you can comfortably afford to make your monthly mortgage payments if you were a novice investor. That approach, even though gives you less liquidity for day to day expenses, would probably give you the highest…

Are your property agents lying to you about the Return On Investments (ROI) for your investment property?

Mr Kua Simi: “Hi there, I’m really interested to know more about this property. I’m thinking of buying it as an investment property. Could you tell me what is the Return On Investment (ROI) for it? Singapore Property Agent: “Good Day Mr Kua Simi, the property sale price is at $1Mil and the expected rental…

Should I use my CPF to pay for my mortgage loan?

Guy: “Hey dear, want to buy house together?” Girl: “You got money to buy house meh?”Guy: “Gahment give me CPF to use so no problem la!!” We Singaporeans know this line too well. You found the love of your live and you are looking for your happily ever after. But cash is tight and you…

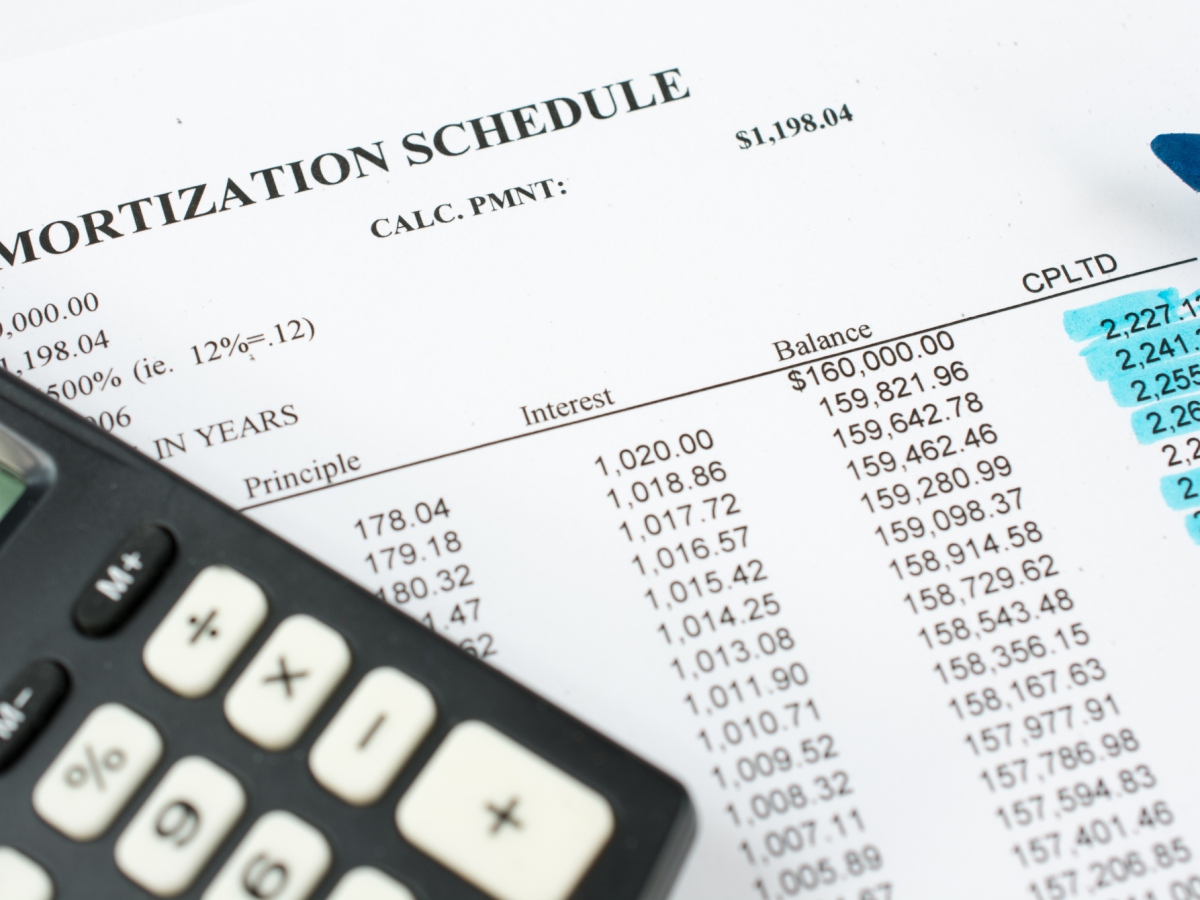

What is Amortization Rates and how does that relate to my mortgage loan?

What is amortization rate? Directly extracted from Investopia the definition of amortization rate is as shown below. “An amortization schedule is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term. While…

Follow My Blog

Get new content delivered directly to your inbox.